How to Trade Forex on SuperForex

How to place a New Order on SuperForex MT4

Firstly, you need to download and log in to the SuperForex MT4 platform on your device. If you are unsure how to do this, please refer to the instructions in the following article: How to Login to SuperForex.

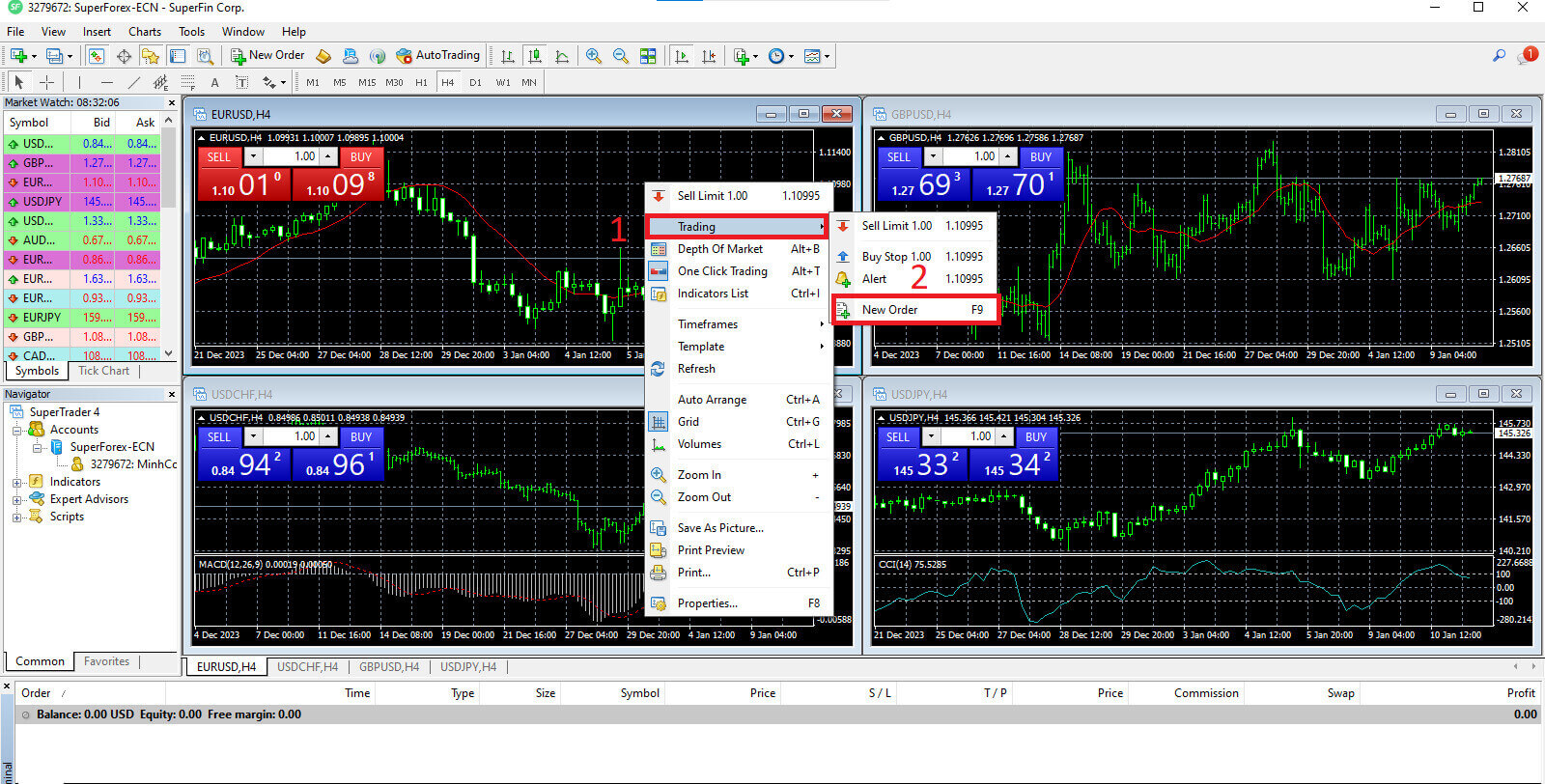

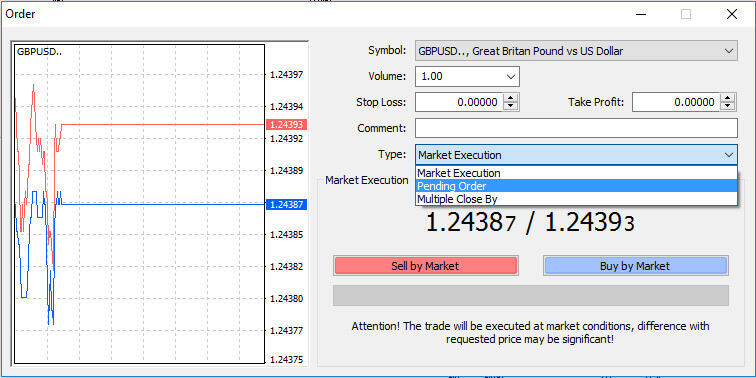

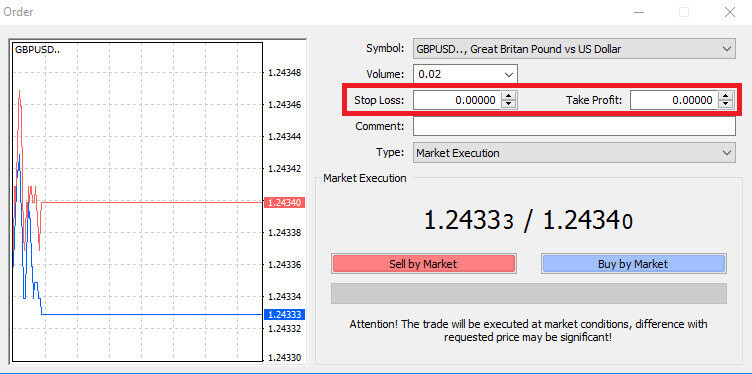

Execute a right-click on the chart, proceed to the "Trading" menu, and opt for "New Order". Alternatively, initiate a double-click on the specific currency within MT4 where you intend to place an order, prompting the appearance of the Order window.

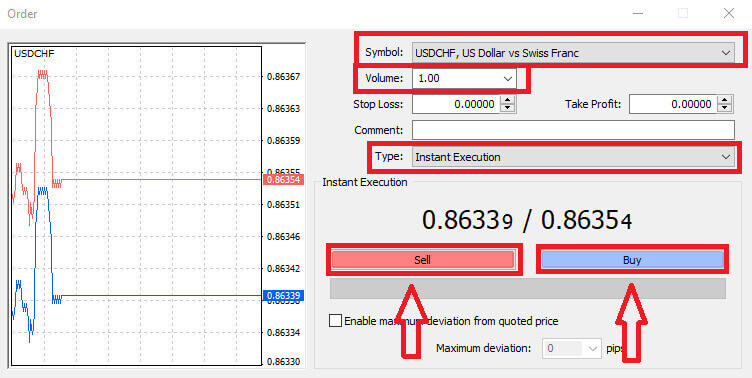

Symbol: Verify that the currency symbol you intend to trade is visibly presented in the symbol box.

Volume: Determine the size of your contract by either selecting the volume from the dropdown box options after clicking the arrow or manually inputting the desired value by left-clicking in the volume box. It is crucial to acknowledge that the contract size directly influences potential profit or loss.

Comment: While not mandatory, you have the option to use this section to annotate your trades, providing additional identification.

Type: The default setting is market execution. Market Execution involves executing orders at the prevailing market price. Alternatively, a Pending Order is employed to establish a future price at which you plan to initiate your trade.

Ultimately, you must decide on the order type, choosing between a sell or a buy order.

Sell by Market orders are initiated at the bid price and closed at the asking price, potentially yielding a profit if the price decreases.

Buy by Market orders are initiated at the ask price and closed at the bid price, offering the potential for profit if the price rises.

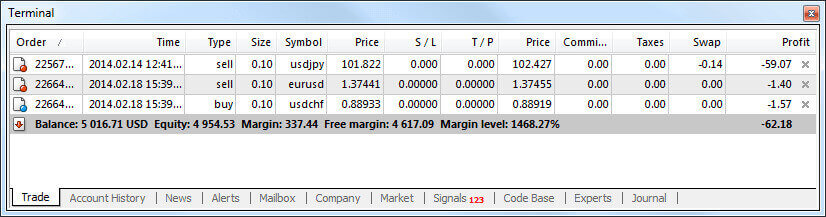

Upon selecting either Buy or Sell, your order will be promptly processed, and you can monitor its status in the Trade Terminal.

How to place a Pending Order on SuperForex MT4

How Many Pending Orders

In contrast to instant execution orders, which are executed at the current market price, pending orders enable you to establish orders that activate once the price reaches a predetermined level of your choosing. While there are four types of pending orders available, they can be broadly categorized into two main types:

- Orders anticipating a breach of a specific market level.

- Orders anticipating a rebound from a particular market level.

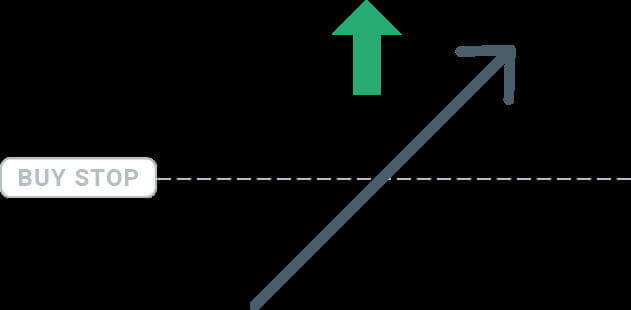

The Buy Stop order empowers you to establish a buy order positioned above the prevailing market price. In practical terms, if the current market price stands at $200, and your Buy Stop is set at $220, a buy or long position will be initiated once the market attains that specified price point.

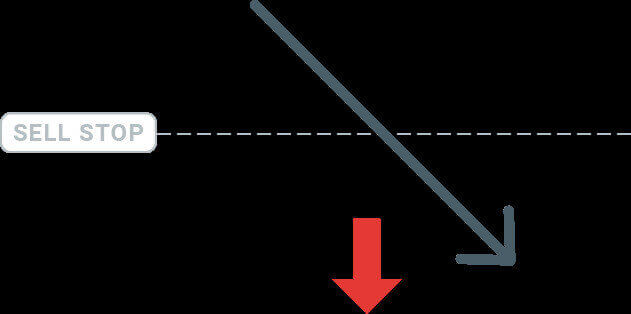

Sell Stop

The Sell Stop order provides the capability to establish a sell order positioned below the current market price. In practical terms, if the prevailing market price is $200 and your Sell Stop price is set at $180, a sell or ’short’ position will be initiated once the market attains that specified price point.

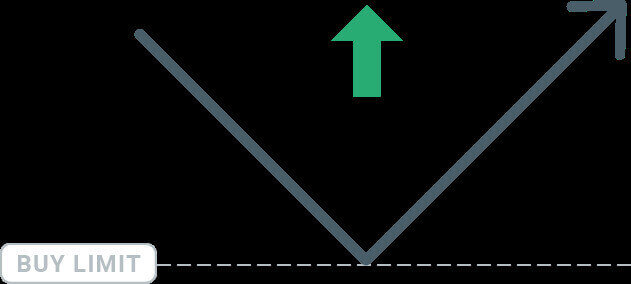

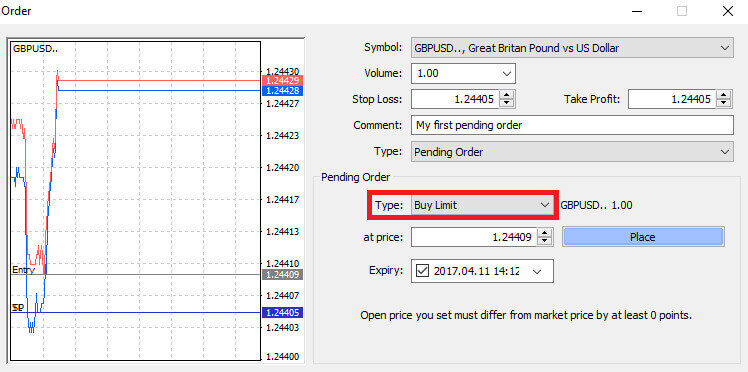

Buy Limit

In contrast to a buy stop, the Buy Limit order enables you to establish a buy order positioned below the existing market price. In practical terms, if the current market price is $200 and your Buy Limit price is set at $180, a buy position will be initiated once the market reaches the specified price level of $180.

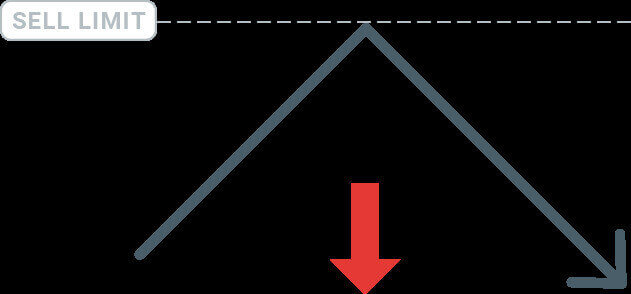

Sell Limit

Concludingly, the Sell Limit order provides the capability to establish a sell order positioned above the prevailing market price. In practical terms, if the current market price stands at $200 and the designated Sell Limit price is set at $220, a sell position will be initiated once the market attains the specified price level of $220.

Opening Pending Orders

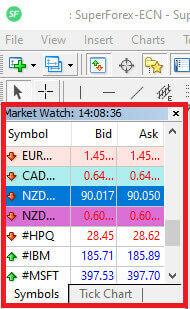

To initiate a new pending order, you can efficiently do so by double-clicking on the market name within the Market Watch module.

This action prompts the opening of the new order window, allowing you to subsequently modify the order type to a Pending order.

Proceed by specifying the market level at which the pending order will be triggered. Additionally, determine the position size based on the chosen volume.

If required, you have the option to establish an expiration date (’Expiry’). Once all these parameters are configured, choose the appropriate order type, considering whether to go long or short and include stop or limit parameters. Finally, select the ’Place’ button to execute the order.

As evident, the MT4 platform incorporates potent features in the form of pending orders. These prove particularly beneficial when you are unable to continually monitor the market for your desired entry point or when the price of a financial instrument undergoes rapid fluctuations, and you seek to seize the opportunity without any potential oversight.

How to close Orders on SuperForex MT4

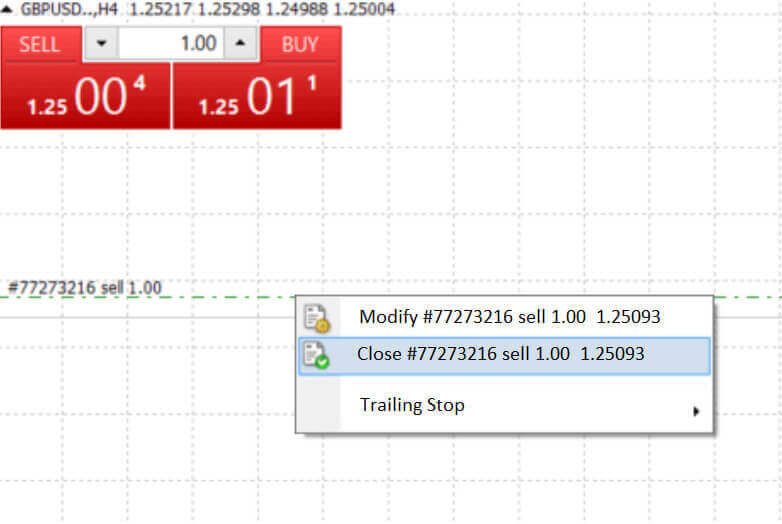

To conclude an open position, click on the ’X’ symbol located within the Trade tab of the Terminal window.

Alternatively, you can right-click on the order line within the chart and choose the ’close’ option.

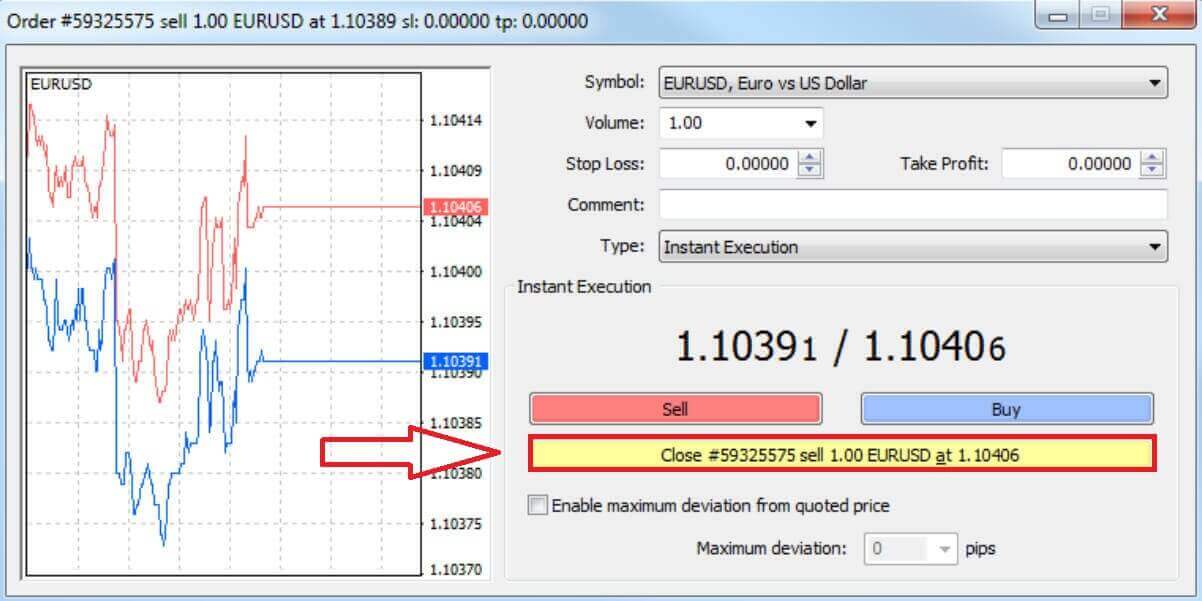

If you wish to partially close a position, right-click on the open order and choose ’Modify’.Then, in the Instant Execution section, choose the Close button.

Using Stop Loss, Take Profit, and Trailing Stop on SuperForex MT4

Setting Stop Loss and Take Profit

The initial and most straightforward method to incorporate Stop Loss or Take Profit into your trade is by implementing them immediately during the placement of new orders.

To achieve this, simply input your specific price level in the Stop Loss or Take Profit fields. It’s crucial to note that the Stop Loss is automatically triggered when the market moves adversely to your position (hence the term "stop losses"), while Take Profit levels are automatically executed upon reaching your specified profit target. This flexibility allows you to set your Stop Loss level below the current market price and the Take Profit level above the current market price.

It’s essential to recognize that both Stop Loss (SL) and Take Profit (TP) are invariably linked to an open position or a pending order. Adjustments to these levels can be made once your trade has been initiated and you are actively monitoring the market. While these serve as protective orders for your market position, it’s worth noting that they are not obligatory for opening a new position. Although you can add them later, it is highly recommended to consistently safeguard your positions.

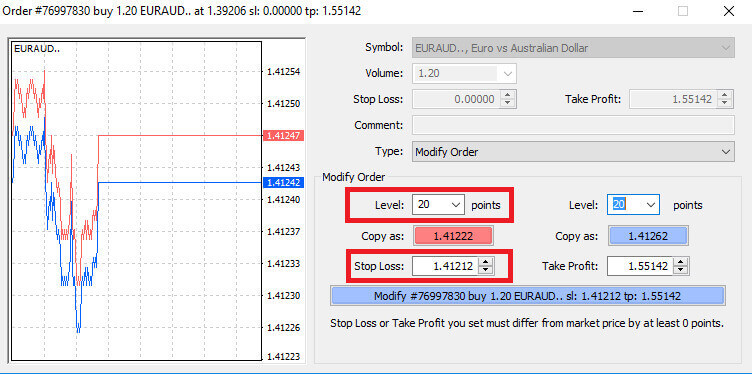

Adding Stop Loss and Take Profit Levels

The most straightforward method to incorporate Stop Loss (SL) and Take Profit (TP) levels into your existing position is by utilizing a trade line on the chart. To achieve this, simply drag and drop the trade line to the desired level, either upward or downward.

After inputting the Stop Loss (SL) and Take Profit (TP) levels, corresponding SL/TP lines will become visible on the chart. This method also facilitates a swift and straightforward adjustment of SL/TP levels.

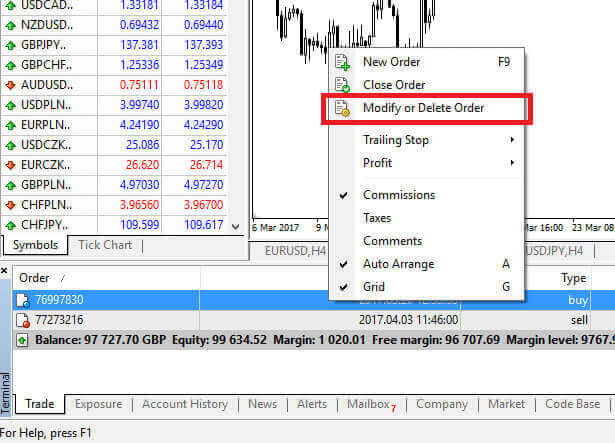

An alternative approach is to accomplish this through the ’Terminal’ module at the bottom. To add or modify SL/TP levels, right-click on your open position or pending order, and select ’Modify or Delete order’.

The order modification window will be displayed, providing you with the capability to input or adjust Stop Loss (SL) and Take Profit (TP) levels either by specifying the precise market level or by defining the points range relative to the current market price.

Trailing Stop

Stop Loss orders serve the primary purpose of mitigating losses in the event of adverse market movements; however, they can also function as a means to secure profits.

While this may seem counterintuitive initially, it is relatively straightforward to comprehend and master.

For instance, suppose you’ve initiated a long position, and the market is currently moving in a favorable direction, resulting in a profitable trade. At this point, you have the option to adjust your original Stop Loss, initially placed below your opening price. You can either move it to your open price (breaking even) or position it above the open price, ensuring a guaranteed profit.

To streamline this process, the use of a Trailing Stop can be employed. This proves to be a valuable tool for risk management, especially during swift price changes or when continuous market monitoring is challenging.

With a Trailing Stop, once the position becomes profitable, it automatically tracks the price, maintaining the predetermined distance established earlier.

Expanding on the aforementioned example, it is crucial to note that for the Trailing Stop to secure a guaranteed profit, your trade must be generating a profit substantial enough to enable the Trailing Stop to surpass your open price.

Trailing Stops (TS) are linked to your active positions; however, it is essential to bear in mind that if you have a Trailing Stop set on MT4, the platform must remain open for its successful execution.

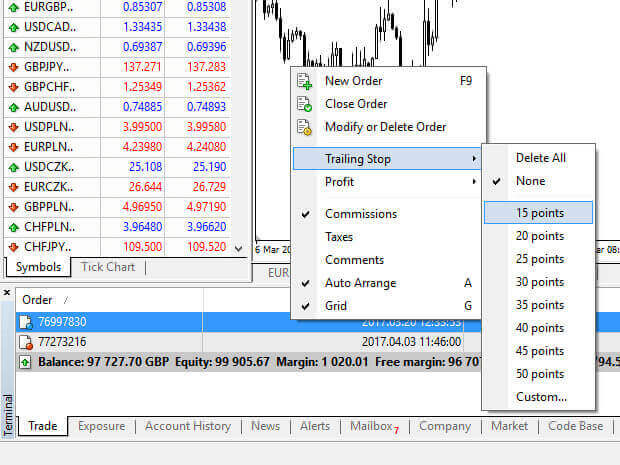

To establish a Trailing Stop, right-click on the active position within the ’Terminal’ window, and define your preferred pip value as the distance between the Take Profit (TP) level and the current market price in the Trailing Stop menu.

Your Trailing Stop is now in effect. Consequently, in the event of favorable market price changes, the Trailing Stop will automatically adjust the stop-loss level to follow the price.

Deactivating your Trailing Stop is a straightforward process; simply select ’None’ in the Trailing Stop menu. For a swift deactivation across all open positions, opt for ’Delete All.’

MT4 offers a range of tools to safeguard your positions efficiently within a short timeframe.

While Stop Loss orders are among the most effective methods for managing risk and limiting potential losses to acceptable levels, it’s important to note that they do not provide absolute security. Although they are free to use and offer protection against adverse market movements, they cannot guarantee the execution of your position every time. In situations of sudden market volatility, where the market leaps beyond your stop level without trading at the intervening levels (known as price slippage), your position might be closed at a less favorable level than anticipated.

For an added layer of assurance, guaranteed stop losses, which eliminate the risk of slippage and ensure closure at the specified Stop Loss level even if the market moves unfavorably, are available at no cost with a basic account.

Frequently Asked Questions (FAQ)

How can I change the leverage of SuperForex’s trading account?

To change the leverage setting for your live trading account, you first need to close all open orders and pending orders in the account.

Then send an email to [email protected] from your registered email address.

Make sure to include the following information in the email.

- Trading Account Number.

- Phone Password.

- Your Preferred Leverage.

You can also request a leverage change through the live chat window on the home page by providing the same information.

SuperForex offers leverage from 1:1 to 1:2000.

The highest leverage 1:2000 is available only for the Profi-STP account type.

For other account types, you can choose to set up 1:1000 leverage.

Note that if your account is participating in SuperForex’s bonus promotions, you may not be able to increase the leverage by more than a certain level.

For more information, you may refer to the “terms and conditions” of the promotion you participated in.

Does SuperForex provide fair and transparent market prices?

As an NDD (No Dealing Desk) broker, SuoerForex provides fair and transparent market prices through the MT4 trading platforms.

SuperForex does not interfere with clients’ orders or manipulate market prices.

For more information about the order execution on SuperForex MT4, see “Types Of Accounts”.

Central to SuperForex’s business model is to always provide the most attractive trading conditions on the market.

SuperForex can offer you excellent spreads on all major currency pairs because SuperForex is a No Dealing Desk broker, and as such has a working relationship with many liquidity providers.

These international institutions are the basis for SuperForex’s always current bid and ask prices, ensuring your trading is guided by fairness and transparency.

- BNP Paribas.

- Natixis.

- Citibank.

- UBS.

The price feeds you see on SuperForex MT4 are aggregated prices of the above liquidity providers.

SuperForex does not manipulate the price feeds, and all clients’ orders are sent to the liquidity providers from SuperForex MT4 directly without interruptions.

Why there is a price gap on SuperForex MT4?

If you see a gap/space in the flow of market price on SuperForex MT4, it could be one of the following reasons:

The market has closed and opened.

If the market has closed and opened again, there could be a gap between the closing price and the opening price. It is due to the pending orders executed at once when the market opens.

The market liquidity is extremely low.

If the market liquidity is extremely low, the price quotes can often jump to another price. In this case, you can say that it is one of the characteristics of the market.

An error by a liquidity provider.

If there is an error quote sent by one of SuperForex’s liquidity providers, there could be an irregular price quote appearing in the chart.

To find out the exact reason for a certain market movement, contact SuperForex’s multilingual support team.

SuperForex is not a Market Maker broker, but an NDD (No Dealing Desk) broker.

SuperForex aggregates multiple price quotes by liquidity providers (BNP Paribas, Natixis, Citibank, and UBS) and provides them on the MT4.

SuperForex does not interfere with clients’ orders or manipulate price quotes.

Mastering the Markets: Successful Forex Trading on SuperForex

To sum up, trading forex on SuperForex is an empowering journey. Just follow the steps and use the tools provided to confidently dive into the dynamic forex markets. SuperForex’s easy-to-use interfaces and strong trading features show they’re dedicated to empowering traders at every level.